Financial Fitness with The Money Doctor with Frances Rahaim, Ph.D.

BBS RADIO STATION 1

VIDEO-TV and RADIO icons

- press to watch or listen -

Video: https://bbsradio.com/bbsradiotv/bbs-radio-tv.html

Audio: https://bbsradio.com/html5_player/html5_player.htm

*** SCROLL DOWN to Listen to SHOW ARCHIVES ***

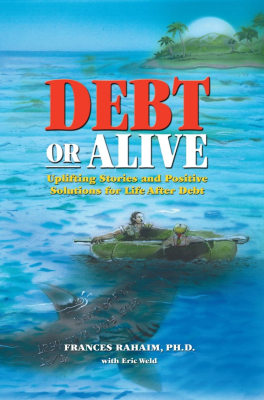

They Found Their Way Out of Debt— Now, So Can You Finally. A book about debt unlike any other. Debt or Alive, a new book by Frances Rahaim, Ph.D. (the Money Doctor), offers readers something that no other book does. It tells the true stories of people just like you— people whose lives were dragged down by debt; who struggled to find solutions and an alternative—any alternative—to debt for the rest of their lives. The dramatic stories told in this book are true in every detail, and shared by people who discovered a path to debt freedom —100 percent, including their mortgage. That discovery changes every single one of their lives. Marriages improve. Futures brighten. College options become a reality. Money becomes a positive notion rather than a source of dread or worry. Debt or Alive declares loudly, that there is life after debt. They too thought they would never find their way out. Some felt the heavy blanket of debt weighing them down, considering debt settlement or bankruptcy. Some just wanting better money–management skills and a brighter retirement. What they all discover, as told through their stories in Debt or Alive, is that there is a way to break completely free of debt without extreme measures like ruining your credit, making higher payments every month or filing bankruptcy. It’s all told in Debt or Alive So Much More Than Stories But more than moving stories, Debt or Alive is an important practical guide to improving your financial picture – whatever it may be. Debt or Alive offers chapters on: Debt Settlement and Debt Consolidation—what are they and how do they work? Building a Better Retirement How to Make a Solid Household Budget Paying for College Good Debt vs. Bad Debt Refinancing Managing Medical Debt and much more! Debt or Alive is a must-read for anyone who is now in debt, has been in debt, or wants to avoid debt in the future. In a little more than 200 entertaining pages you will learn how other people just like you—struggling with debt and not sure where to turn—discovered a way out of debt, 100 percent, including their mortgage. You will also learn practical steps to get or remain free of debt, like: building savings saving money in everyday ways teaching your children about debt strategizing for a debt-free retirement and much more!